This comprehensive article explores the expected impact of a spot Bitcoin ETF on Bitcoin's market value. It emphasizes the crypto community's high anticipation and market sensitivity to related developments. Analysts predict a significant increase in Bitcoin's value post-ETF approval, with potential inflows from regulated investment advisers and parallels drawn to precious metal ETFs.

The crypto community is keenly anticipating the approval of the first spot Bitcoin ETF in the U.S., evidenced by a surge in registration applications from prominent investment firms and a notable increase in related Google searches.

A recent mistaken report by Cointelegraph about the approval of a new Bitcoin ETF product briefly stimulated the market, elevating Bitcoin’s value to the significant $30,000 threshold. The CEO of BlackRock, the firm that submitted the application, attributed this market response to a pent-up demand for digital assets.

This development leads to pertinent questions: What distinguishes this ETF, and how might the introduction of such exchange-traded funds impact Bitcoin's price?

Single Broker endeavored to understand the implications of this innovation for the cryptocurrency market, gathering a range of expert forecasts.

Analysts anticipate a substantial inflow of funds into the spot Bitcoin ETF, contingent upon its approval by the SEC. This is expected to correspond with a notable increase in Bitcoin's price.

Some experts believe that the U.S. regulator will approve all pending applications for the new product, aiming to prevent any single company from gaining a first-mover advantage.

BlackRock Managing Director Steven Schonfield projects that the SEC might register the first spot Bitcoin ETF within the next three to six months. In contrast, specialists at QCP Capital express skepticism about the regulator's willingness to approve applications for new financial instruments before year-end.

Why is a spot Bitcoin ETF so important?

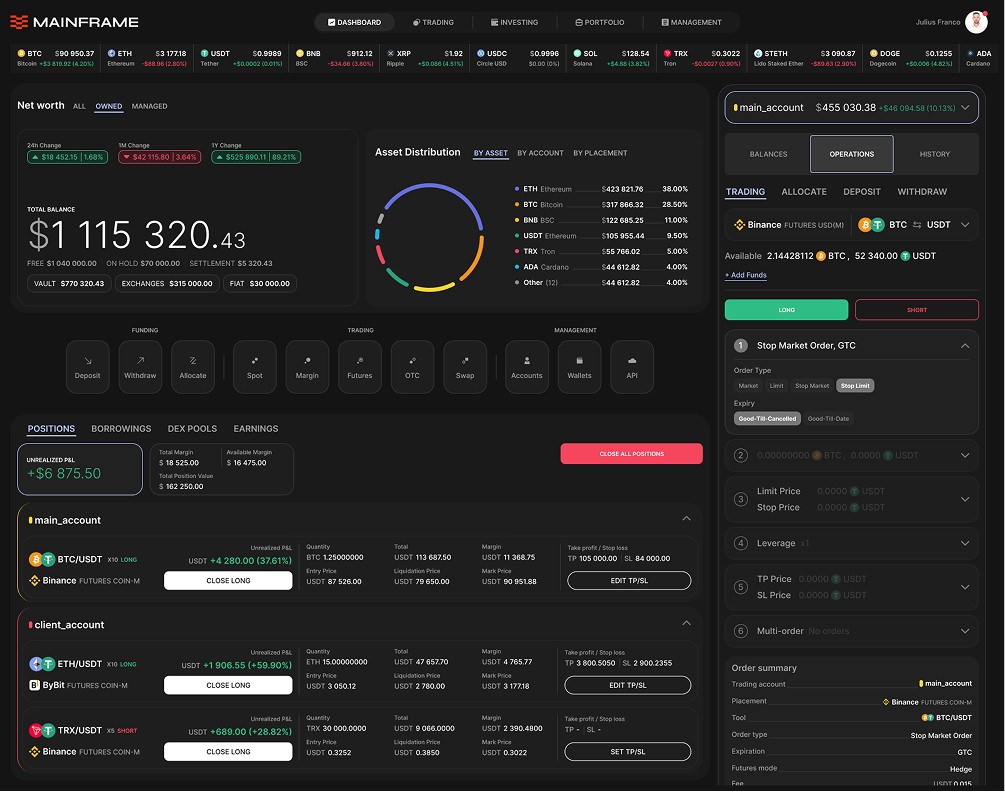

Experts at Galaxy have identified the primary advantages of a spot exchange-traded fund (ETF) based on Bitcoin, compared to current alternatives such as Exchange-Traded Products (ETPs) and closed-end funds:

Enhanced efficiency in terms of fees, liquidity, and accurate price tracking.

Increased convenience due to accessibility via a broader range of channels and platforms.

Compliance with regulatory standards, potentially leading to decreased volatility.

Furthermore, according to these experts, a spot Bitcoin ETF could significantly boost the asset's popularity due to:

Wider accessibility for individuals across various wealth categories.

Formal recognition by regulatory authorities and key entities in the financial services sector.

Galaxy analysts report that as of September 30, there were approximately 841,637 BTC (valued at around $21.69 billion) held in ETPs and closed-end funds.

To grasp the potential impact of adopting a spot Bitcoin ETF, it's instructive to compare it with analogous products based on precious metals, suggests Gordon Grant, a crypto derivatives trader. He notes that trading volumes in gold-based financial instruments and their derivatives have consistently risen.

The World Gold Council (WGC) reports that as of September 30, gold ETFs held approximately 3,282 tons (valued at about $197.8 billion), representing roughly 1.7% of the global gold supply. Comparatively, on the same date, Bitcoin products encompassed 841,637 BTC (approximately $21.7 billion), accounting for 4.3% of the total issued coins.

Considering that the market capitalization of gold is approximately 24 times higher than Bitcoin, and the availability of investment instruments for gold is 36% less, analysts suggest that the influx of funds, in dollar terms, could have an impact on the Bitcoin market that is 8.8 times greater compared to the precious metals market.

Galaxy analysts highlight that Bitcoin's demand will likely be spurred more by secondary effects following product approval. This includes the potential registration of similar ETFs in other jurisdictions and the incorporation of Bitcoin into diverse asset management strategies.

The long-term Total Addressable Market (TAM) for Bitcoin could potentially encompass all assets managed by third parties, estimated at around $126 trillion according to McKinsey, and might even extend to the broader scope of global wealth, which is approximately $454 trillion as per UBS estimates.

Luke Nolan, a Research Associate at CoinShares, is confident that spot ETFs will streamline institutional investors' access to Bitcoin. He points out, 'There will be no need to worry about storing keys or seed phrases,' emphasizing the reduction in the necessity for in-house security measures for crypto assets.

Nolan also remarks that a spot Bitcoin ETF would significantly influence the 'distribution channels for institutional capital inflows,' facilitating the process for financial institutions managing pension plans like 401(k)s and investment strategies for companies looking to include cryptocurrency in their portfolios.

Impact on Bitcoin price

Numerous experts are expressing optimistic projections. Analysts at Galaxy predict a surge in Bitcoin's price of over 70% within the first year following the approval of a spot Bitcoin ETF in the U.S.

Charles Yu, a researcher at the company, has estimated the short-term Total Addressable Market (TAM) for these new products at approximately $14.4 trillion. This forecast for the future value of Bitcoin is grounded in the anticipated inflows into exchange-traded funds, paralleling trends observed in similar ETFs for precious metals.

Based on Galaxy's model, they expect an increase of about 6.2% in Bitcoin's price within the first month of the ETF's approval.

The study presents the valuation of the first cryptocurrency as of September 30. Projecting an increase of 74.1%, this would imply a price of approximately $59,200 by the end of the 12th month following the introduction of the first spot Bitcoin ETF. The expected inflows of funds into this new financial product in its first year are estimated to be around $14.4 billion.

Markus Thielen, head of research at Matrixport, has made a similar prediction regarding the first cryptocurrency's price. He estimates that the approval of BlackRock's application could lead to an increase in Bitcoin's price to between $42,000 and $56,000.

Experts supporting this forecast point to an expected influx of $24 to $50 billion from regulated investment advisers (RIAs) in the United States. The report highlights that the industry, comprising 15,000 professionals, manages approximately $5 trillion in client capital.

The $50 billion figure mentioned by Matrixport represents about 1% of these RIAs' Assets Under Management (AUM).

In drawing parallels with precious metal ETFs, which are estimated to have a capitalization of around $120 billion, analysts suggest that at least 10% to 20% of investors in this sector might consider a digital gold-based product to hedge against inflation. This translates to an estimated inflow of $12 to $24 billion into the cryptocurrency market.

Such an influx, especially in stablecoins converted from fiat, is expected to elevate Bitcoin's price. An allocation of 1% of AUM, equating to $50 billion, could potentially drive Bitcoin’s price to $56,000.

Analysts at CryptoQuant estimate that the approval of a spot Bitcoin ETF in the United States could increase the cryptocurrency market's capitalization by $1 trillion. They highlight that such an event would likely catalyze a new wave of adoption among institutional investors.

These experts believe that, following Ripple and Grayscale's legal victories over the SEC, the likelihood of approving a spot Bitcoin ETF by March 2024 — the decision deadline — has significantly increased.

The approval is expected to attract approximately $155 billion (about 1% of the AUM of management companies) into the Bitcoin market. This influx could boost Bitcoin's capitalization by $450 to $900 billion, potentially leading to a price increase of 82–165%, with values reaching $50,000 to $73,000.

Arthur Hayes, the former CEO of the BitMEX crypto exchange, in an interview with Tom Bilyeu, projected that the price of Bitcoin could escalate to between $750,000 and $1 million by 2026. He bases his prediction on the potential approval of spot Bitcoin ETFs, the limited supply of Bitcoin, and ongoing geopolitical uncertainties.

Hayes also anticipates that the price of Bitcoin could hit $70,000 in the coming year.

When is the launch?

In October, BlackRock's Managing Director, Steven Schoenfield, expressed optimism that the SEC would register the first spot Bitcoin ETF within the next three to six months.

His colleague, former Director Martin Bednall, speculated that the Commission might approve all applications for cryptocurrency-based exchange-traded funds simultaneously. 'I don’t think they want to give anyone a first-mover advantage,' Bednall suggested.

He estimated that the U.S. approval of spot ETFs could result in $150 to $200 billion inflows into Bitcoin products over three years.

BlackRock submitted an application for a digital gold-based investment product to the SEC on June 15. Following this, Valkyrie, Fidelity Investments, WisdomTree, and Invesco also filed similar requests.

Galaxy Digital CEO Mike Novogratz predicted that the SEC would approve a spot Bitcoin ETF by the end of 2023, citing the August court decision favoring Grayscale Investments against the SEC. The court questioned the SEC’s rationale for not approving a spot ETF while allowing a futures ETF, potentially weakening the SEC's position.

In October, the U.S. Court of Appeals required the SEC to reevaluate Grayscale Investments' request to convert GBTC into a spot ETF based on Bitcoin. The firm plans to list GBTC on the NYSE Arca exchange upon approval of its Form S-3 and 19b-4 filings.

Analysts at JPMorgan also believe that spot Bitcoin ETFs will receive approval 'within months.' They anticipate that approval could occur by January 10, 2024, the deadline for applications from ARK Invest and 21 Co. They highlighted that the SEC might approve all proposals simultaneously to maintain fair competition.

JPMorgan further noted that the SEC could face legal challenges if it rejects these new products.

SEC Commissioner Hester Peirce, in a CNBC interview, remarked that a Bitcoin ETF should have been approved five years ago. She acknowledged a significant difference between her views on digital assets and the SEC’s stance, adding that she 'cannot predict how her colleagues will approach this topic.