Home

Platform

Platform Overview

One KYC

One Interface

Swiss Regulated

300 Assets

Market Challenges

For high-net and institutions, the real barrier isn’t trading — it’s governance: compliance, custody, controls, and auditability across too many disconnected venues.

Low trust + uneven regulation

High counterparty/custody risk

Fragmented liquidity and execution

Weak team permissions

Too many platforms/tools → operational overload

Poor audit trails

Manual API/wallet key management

Reporting/reconciliation is slow and expensive

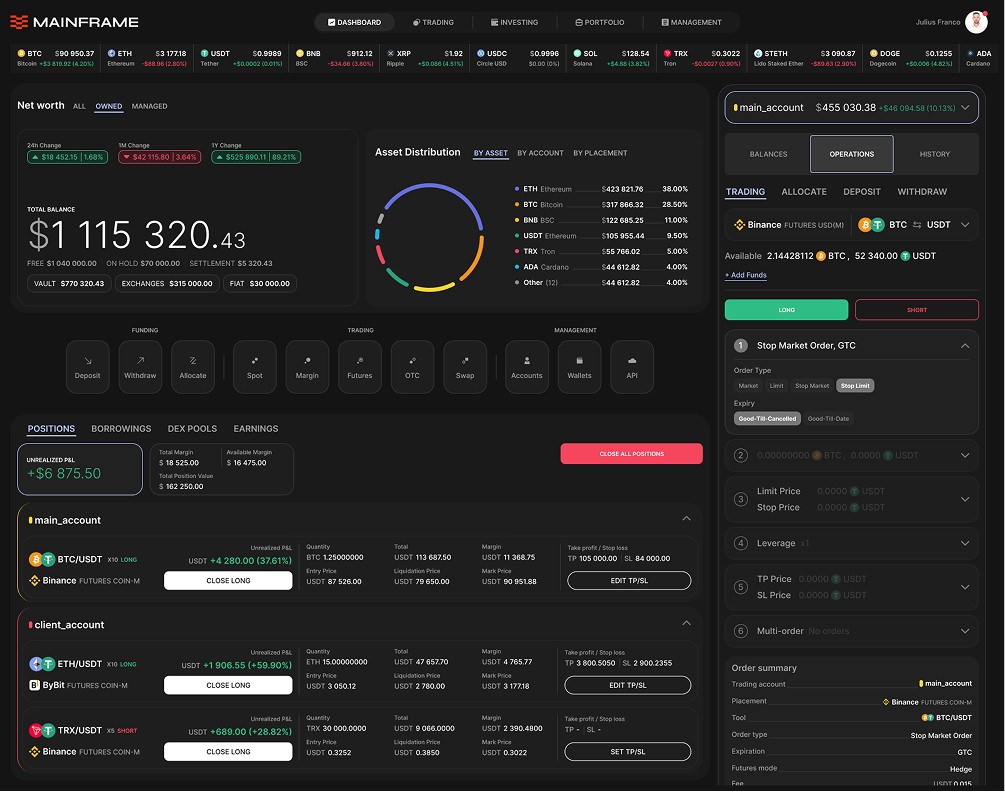

MainFrame Solution

We unified CEX and DEX access with professional analytics and flexible account management into a single platform. Secured by an insured institutional vault and backed by a regulated Swiss entity — built for traders and investors.

Features

Secure asset ecosystem

Bridging the gap between traditional finance and the digital economy. We eliminate the complexity of moving capital between currencies, providing a secure harbor for your assets with the familiar reliability of a Swiss institution.

Feature

Insured Custody

Protect your capital with bank-grade storage backed by comprehensive insurance, eliminating the risk of loss

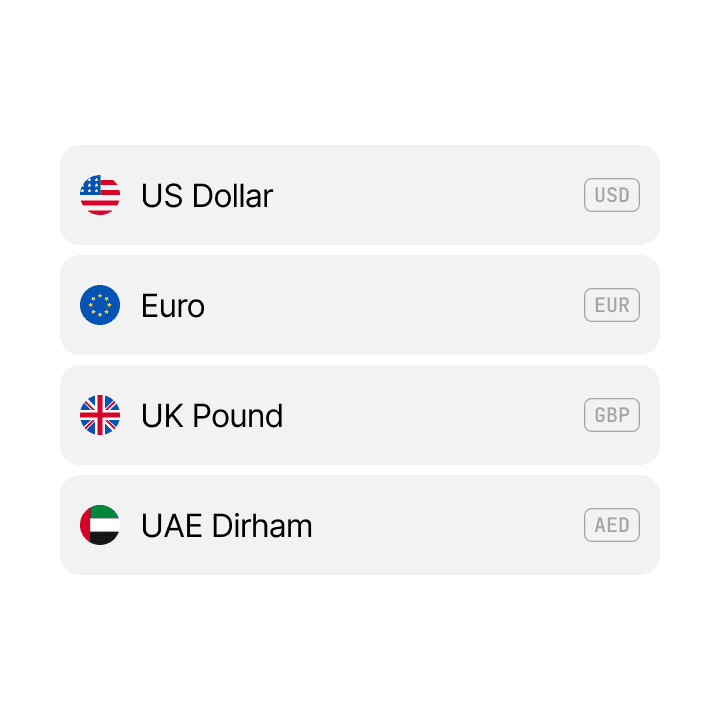

Feature

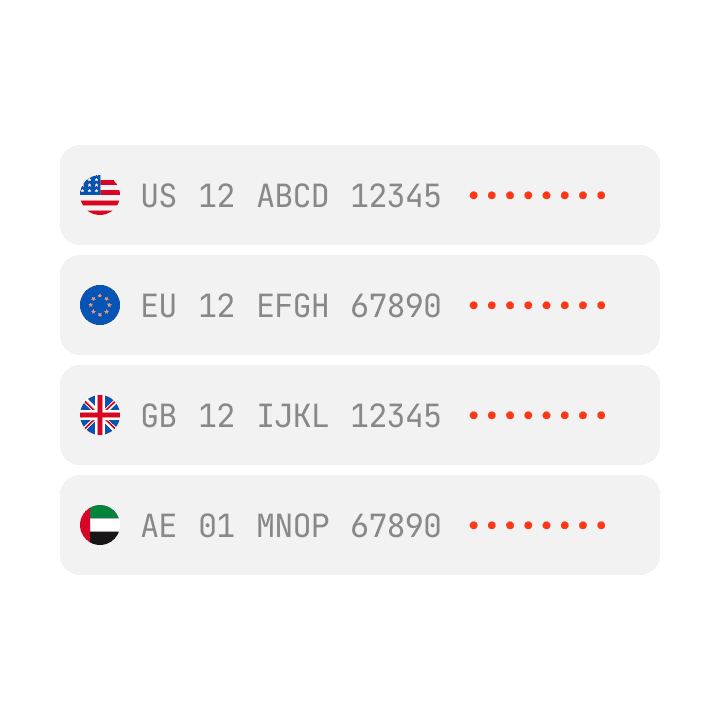

Global Currencies

Operate with supported fiat currencies in you accounts: EUR / USD / GBP / AED, and more coming soon

Feature

Digital Portfolio

Securely deposit and withdraw over 10 leading digital assets and stablecoins through a single, audited entry point

Feature

Instant Exchange

Convert capital into digital assets at the touch of a button, removing the wait times associated with traditional brokerages

Feature

Named IBANs

Benefit from virtual IBANs in your name, ensuring transparent, compliant, and direct transfers without third-party friction

Feature

Assets Allocation

Rebalance your portfolio across currencies and digital assets instantly, ensuring your strategy adapts as fast as the market

Features

Governance and Oversight

Managing institutional wealth requires precision and accountability. Our management suite replaces administrative chaos with a structured environment where every action is tracked, authorized, and optimized for your team’s workflow.

Feature

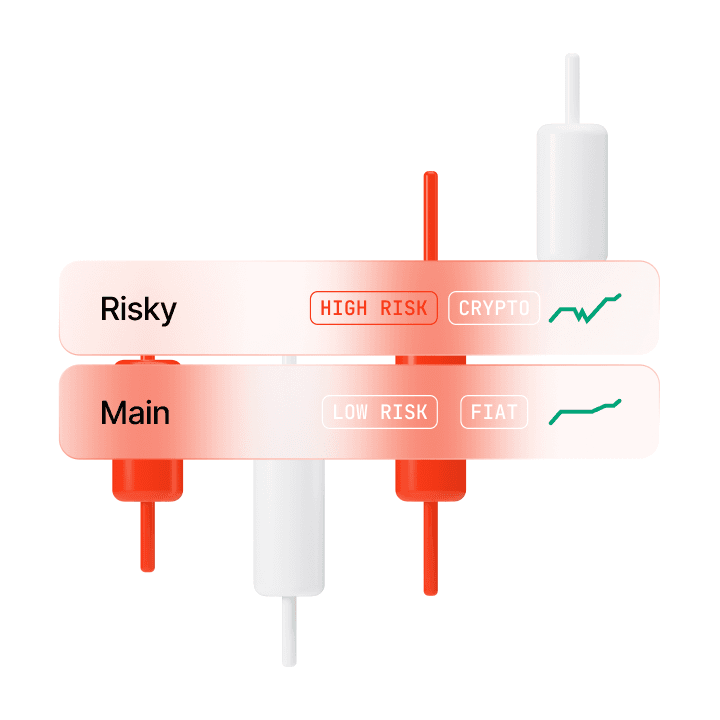

Isolated Trading Segments

Create dedicated accounts for different strategies, featuring built-in performance analytics to see exactly what is driving your growth.

Feature

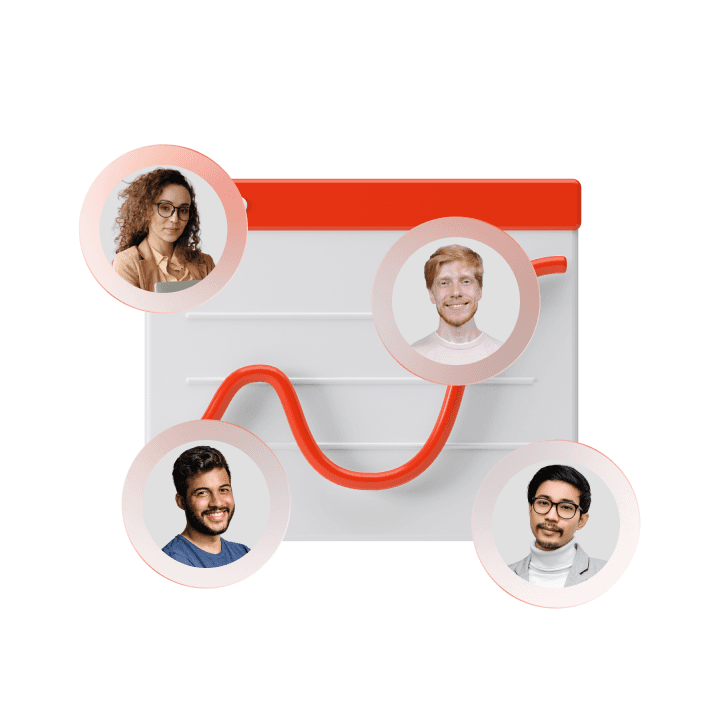

Granular Access Controls

Empower your team or external managers by assigning specific roles and restricted permissions, ensuring your capital is managed without compromising security.

Feature

Smart Profit-sharing Contracts

Automate your management agreements with technical contracts that handle performance fees and distribution accurately and transparently

Feature

Institutional Team Hubs

Organize your portfolio managers into collaborative groups, providing the infrastructure needed for high-level collective decision-making

Features

Executive Trading Suite

Fragmented markets lead to hidden costs. We aggregate global liquidity into a single interface, ensuring you always execute at the best possible price without the need to manage multiple exchange relationships.

Feature

Unified Market

Access

Connect to the world’s leading digital exchanges through one secure gateway, removing the need for fragmented account management

Feature

Preferred Institutional

Rates

Benefit from a low-fee structure designed for high-volume participants, significantly reducing the cost of doing business

Feature

Fixed-rate OTC

Desk

Execute large currency-to-crypto trades at a guaranteed price, protecting capital from volatility during the transaction

Feature

Rapid Decentralized

Swaps

Access deep liquidity pools for instant asset exchanges, ensuring you can enter or exit positions without market delays

Features

Strategic wealth growth

Put your idle capital to work through curated, low-touch investment products. We vet the most reliable opportunities in the digital space so you can focus on long-term wealth preservation and growth.

Feature

Liquidity participation

Earn a share of transaction fees by providing capital to established digital exchange pools, turning market activity into steady revenue

Feature

Flexible earning products

Access interest-bearing accounts with no lock-up periods, allowing you to grow your holdings while maintaining full liquidity

Feature

Secure lending and staking

Earn rewards by supporting network security and institutional lending protocols, backed by rigorous risk management

Feature

Professional managed strategies

Deploy your capital into exclusive investment strategies designed and overseen by our asset manager partners

API Features

Institutional infrastructure (API)

For firms looking to build their own solutions, we provide the raw power of our platform via a unified technical interface. Scale your operations without the burden of building the underlying plumbing.

Feature

Unified integration gateway

Acess our entire suite of features through a single, robust API, reducing development time and technical overhead

Feature

Turnkey infrastructure

Leverage our regulatory and technical framework to power your own fund, fintech startup, or asset management firm.

Integrations